- Mine Wire Media Group

- Posts

- September 24th, 2025 - The Mine Wire

September 24th, 2025 - The Mine Wire

Together With:

The Mine Wire continues to grow with over 12,000+ mining and investment professionals choosing to read our fun yet informative free weekly news publication. We do our best to curate news related to government policy, funding and grant opportunities as well as a host of other corporate news so you stay in the know.

Are you responsible for tracking a host of public information for your organization? Our Executive Briefing powered by Delphic Research brings a customized, professional strategic briefing to your inbox every morning at 7:30am on the minerals, geography, operations, regulatory issues and media that are critical to you. Find out why other companies switched to Delphic. Click on the infographic further below to set up a consultation or message us at [email protected].

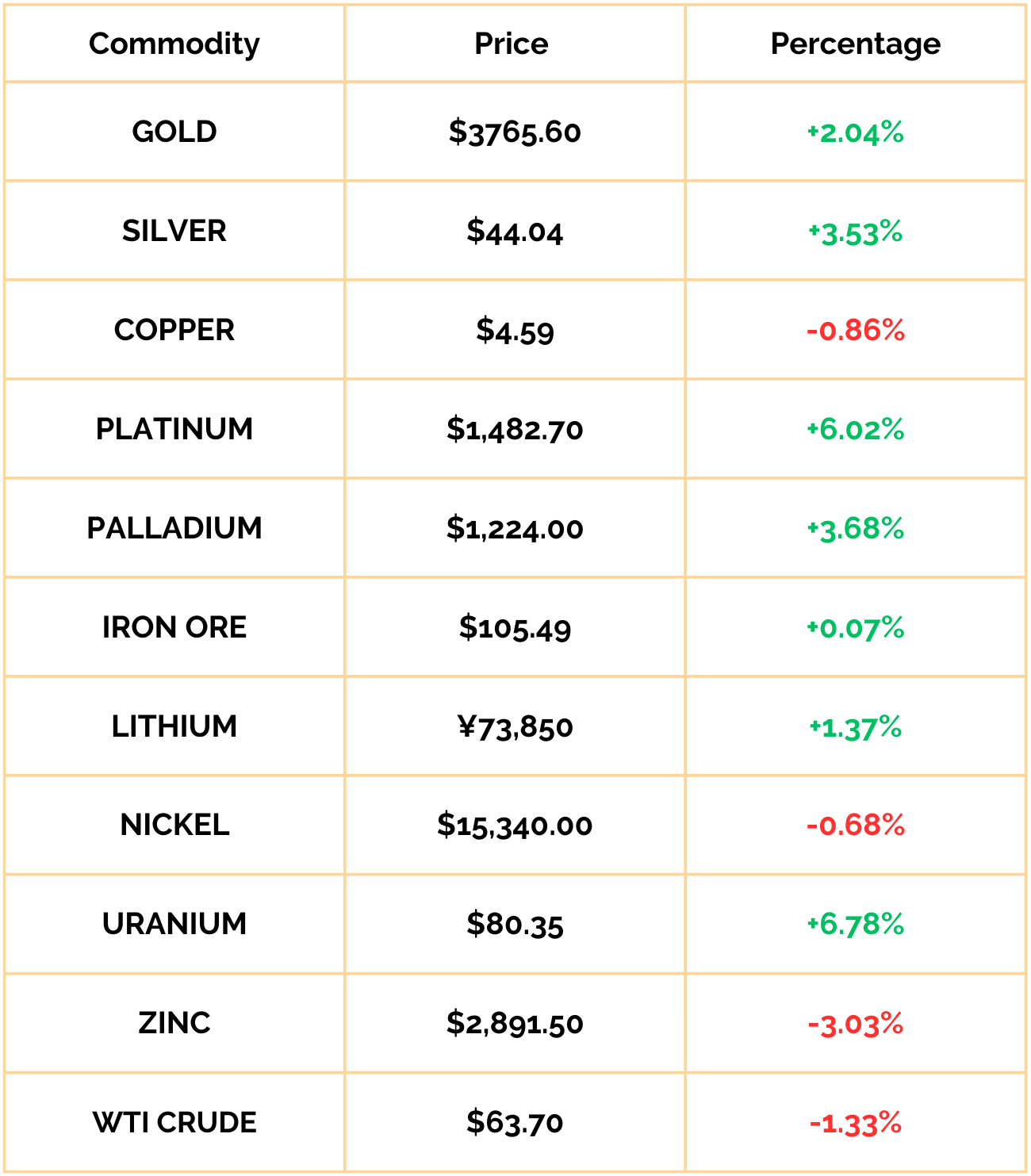

METALS MARKET

📈 Everyone loves to talk about Bitcoin and while it has done very well over the past decade, it is up an unremarkable 15% in 2025. How does that stack up against some precious metals? So far this year, Palladium is up over 37%, Gold 43%+, Silver 52%+ and Platinum 65%+. Further, we can easily list off dozens upon dozens of miners that are up in the high or triple digits in 2025. So if you know an investor sleeping on miners, tell them to wake up!

**For our chart above we are taking prices from Tuesday 4pm EST to Tuesday 4pm EST, so not the typical week of Monday through Friday.

KEEPING AN EYE ON GOVERNMENT DECISIONS

Here are some of the notable government policy moves this week:

🇺🇸 President Trump made waves this past week as he announced a new $100,000 fee for NEW H-1B visa applicants. The White House release says that some employers and sectors, have abused the H-1B statute to artificially suppress wages, impacting American citizens. The release goes on to say that the largest impact has been seen in critical science, technology, engineering, and math (STEM) fields. Additionally, the President announced a new “Gold Card” program which will expediate visa processing for a cool $1m paid by the individual or $2m by a corporation on behalf of an individual. (White House)

🇺🇸 According to Reuters, the Trump administration through the Department of Energy is seeking an equity stake of as much as 10% in Lithium Americas (TSX: LAC) as it renegotiates terms of the company’s $2.26bn Energy Department loan for its Thacker Pass lithium project. Lithium Americas was up over 75% at the market open today.

🇺🇸 🇺🇦 Ukraine and the U.S. International Development Finance Corporation will each commit $75m to a joint investment fund that will focus on projects in energy, infrastructure, and critical minerals. The government aims to implement 3 large scale projects through the end of 2026. While the amount is a drop in the bucket of what is needed, it should allow a testing of the waters so to speak.

🇺🇸 Last week, United States Senators Bill Hagerty (R-TN) and Catherine Cortez Masto (D-NV) introduced the Restoring American Mineral Security Act to establish a Critical Minerals Security Alliance with America’s global trading partners. Basically those Nations who agree to increase tariffs on critical minerals from China along with a host of other measures would be exempt from U.S. tariffs on critical minerals and on certain products made from them. (Senator Hagerty)

🇺🇸 The United States Select Committee on the CCP issued a letter to President Trump calling for stronger actions against China in response to the “ongoing weaponization of critical mineral and rare earth supply chains.” The committee is calling for: Restricting or suspending Chinese airline landing rights at U.S. and allied airports; Reviewing and potentially tightening export controls on commercial aircraft, parts, and services to China and; Coordinating with allies to restrict outbound investments into China’s aviation sector. The European Union Chamber of Commerce in China this week said that more manufacturing shut-downs are expected as China continues its tight grip on rare earth exports. (Select Committee)

🇨🇦 Canada’s Energy Ministers met last week at the Connecting Canada – Building an Energy Superpower Summit hosted by Ontario, Energy and Mines Minister Stephen Lecce. As part of the summit, Ontario hosted the minsters for a tour of the Darlington Nuclear Generating Station. The Ministers were presented with public opinion data that profiles growing and widespread support for nuclear energy. We make no secret of it, we absolutely love nuclear power and commend Ontario for its leadership here. (Ontario Government)

🇨🇦 The Mining Industry Human Resources Council is receiving $1,533,200 from the Ontario Government to deliver a two-phase training program combining online modules, immersive VR simulations and paid work placements. Targeting underrepresented groups, the program develops safety and operational skills while connecting learners directly to employers through a custom-built job-matching platform. Ryan Montpellier, Executive Director of the MIHRC said, “Mining employers will have access to a job matching platform to facilitate training participant work placements, providing real workplace experience and the potential for permanent employment." (Ontario Government)

🇨🇩 The Democratic Republic of Congo will lift its ban on cobalt exports from October 16th and manage global supply by imposing annual export quotas. Cobalt is up over 42% in 2025 thanks to the government’s intervention. Miners will be allowed to ship up to 18,125 tons of cobalt for the rest of 2025, with annual caps of 96,600 tonnes in 2026 and 2027. (Reuters)

🇮🇩 The Indonesian Ministry of Energy & Mineral Resources (ESDM) has sanctioned 190 mining companies due to a lack of reclamation and post-mining guarantees. The sanctions will be lifted once the companies submit a reclamation plan and provide the necessary guarantees.

🇮🇳 India has signed a 15-year contract with the International Seabed Authority for exclusive rights to explore polymetallic sulphides in the Indian Ocean. It is also seeking other exploration licenses in the Pacific Ocean.

🇺🇳 Meanwhile Morocco became the 60th nation to ratify The High Seas Treaty, meaning it will come into effect in 120 days. The High Seas Treaty is the first legal framework aimed at protecting biodiversity in international waters. Still, large nations like the United States, China, Russia and Japan have not ratified the treaty, so its effectiveness is being questioned since nations are meant to police their own vessels in international waters. (AP News)

MINING MATTERS FROM AROUND THE WORLD 🌎

Perpetua Resources in Idaho

🇺🇸 Last Friday, Perpetua Resources (TSX: PPTA, NASDAQ: PPTA) received U.S. permission to begin construction of its antimony and gold mine in Idaho. The project seeks to redevelop an abandoned mine site in Stibnite for gold and other materials. One of the key materials resulting from the gold mining operation is antimony sulfide, a critical component used in ammunition production. Lots of dignitaries were at the launch including the Governor who said, “The Stibnite project currently holds the largest identified reserve of antimony in the U.S. At an estimated 148 million lbs., it is one of the largest antimony reserves outside of foreign control.” The stock is up 130% the past year. (U.S. Army)

🇨🇦 Denver-based Newmont Corp. was the second miner in as many weeks to exit their position in Canada’s Orla Mining (TSX: OLA). Newmont sold 43m common shares at a price of US$10.14 (C$14.00), for aggregate gross proceeds of US$439 million (C$605 million). Given Orla’s strong performance over the past year, it isn’t surprising to see large miners take profits to allocate to other capital priorities.

🇨🇦 Another Canadian miner was locking up a new investment as Ivanhoe Mines’ (TSX: IVN) secured a US$500m investment from the sovereign wealth fund of the State of Qatar. The Qatar Investment Authority (QIA) will own roughly 4% of the company which intends to use the proceeds from the investment to advance growth opportunities related to the exploration, development, and mining of critical minerals, as well as for general corporate purposes. Ivanhoe is down more than 31% the past year.

🇭🇰 Zijin Gold International will debut on the Hong Kong stock exchange on September 29th. The company is looking to raise HK$28.7bn (US$3.7bn) at a valuation of US$24.6bn. The company is planning to use the proceeds over the next five years to upgrade existing mines.

🇦🇺 The BHP Mitsubishi Alliance's (BMA) Saraji South, part of the Saraji Mine Complex, will be placed into care and maintenance from November 2025, impacting 750 jobs. The company and analysts are pointing the finger at the Queensland government and their royalty scheme while the government says they have no plans to change the scheme. The Mining & Energy Union President said, “BHP should stop using coal workers and communities as pawns in its fight with the Queensland Government over royalties.” (Reuters)

🇦🇺 BMA wasn’t the only one reducing headcount in Queensland’s coal industry this week, as Anglo American reportedly eliminated 200 roles at its Grosvenor coal mine and Brisbane office. Resource analyst Gavin Wendt said, "Companies have to cut costs, and those costs have to be cut because there is just no margin there… The margins are shrinking for coal companies." (ABC News)

🇦🇺 🇺🇸 Fleet Space Technologies has signed a MoU with ExLabs to deploy its off-world exploration technologies to survey the asteroid Apophis as part of ExLabs’ ApophisExL mission planned for launch in 2028. On April 13, 2029, the asteroid will pass approximately 32,000 kilometers from Earth’s surface - closer than geosynchronous satellites. Such close flybys of large asteroids are extremely rare, occurring only once every 7,500 years. This is very cool and we send lots of positive thoughts for a successful mission.

🇨🇴 Aris Mining Corporation (TSX: ARIS, NYSE-A: ARMN) confirmed that 23 underground miners have been trapped at the La Reliquia Mine in Colombia. The mine is a formalized third-party operation located within Aris Mining's Segovia title, but outside of Aris Mining's infrastructure. The miner reported that “all workers are in good health, regular telephone communication has been maintained, and food, water, and ventilation are being delivered safely while rescue work progresses.” We hope for a speedy rescue. Thoughts with all the miners and their families.

🇵🇪 Hudbay Minerals Inc. (TSX: HBM) put out a release this morning due to the the riots in Lima and protests across the country. Out of an abundance of caution the miner has temporarily shut down operations at its Constancia mine to give authorities time to deal with the social unrest. Hudbay said it will use the downtime to focus on maintenance and is not expecting this shut down to impact overall production guidance for the year.

MINING BITS

🇬🇧 Rio Tinto, in partnership with Founders Factory, has unveiled six new investments spanning laser-based superdeep drilling, ecosystem restoration, robotic revegetation solutions, mineral waste valorisation for extracting critical metals and nature and biodiversity monitoring. The six investments are: 🇨🇭 DNAir, 🇺🇸 Foray, 🇺🇸 FAST Metals, 🇩🇪 Hades, 🇺🇸 Namu Robotics and 🇳🇴 Spoor. Over the past 18 months, Founders Factory, together with Rio Tinto Ventures, has reviewed over 1,500 startups globally to select 18 investments – including this current cohort above. Congratulations to all of the companies selected!

🇲🇽 AP News takes a look at the illegal mercury mining trade in Mexico and how illegal operations throughout the Amazon have helped prices increase tenfold over the past 15 years. Fernando Díaz-Barriga, a medical researcher who has long studied mercury mines in central Mexico says, “for the first time in their lives, mercury is worth something, and the miners are saying: ‘It’s worth poisoning myself if I’m going to earn something.” AP points out that it is the smugglers (‘Coyotes’) making money off the back of the miners. What they purchase for 500 pesos in Mexico, can be sold in Peru for 5,000. Lots of pictures and background - definitely worth a read. (AP News)

🌍 Several fellows at the Brookings Institute argue that Africa can provide easier and faster solutions to the U.S. critical minerals crisis when compared to Ukraine, Greenland, and Canada. While we generally agree with the six recommendations made, we particularly like the suggestion that: “Mineral diplomacy without the private sector will fail. The private sector can pinpoint the most significant governance, financial, and social risks and untapped investment opportunities with regard to critical minerals. Ideas like more investment, local processing and broader economic development all make sense to us, but have to come with rule of law and security guarantees. What do you think? (Brookings)

🇸🇦 Future Minerals Forum (FMF) returns to Riyadh on 13–15 January 2026 as the world’s largest convening dedicated to the future of minerals and metals. FMF brings together government ministers, CEOs, investors, end-users, and innovators from 120+ countries to tackle supply, sustainability, technology, and financing for the energy transition. The three-day program features leadership keynotes, roundtables, market spotlights, an international exhibition, and curated networking and deal-making. Details and registration at futuremineralsforum.com.

Not Signed Up to The Mine Wire Yet?

We do the hard work and curate news from around the globe related to mining and bring it to you once a week in a free and easy to read format. Whether you’re a seasoned industry professional or a curious enthusiast, our newsletter delivers the latest updates, cutting-edge trends, and expert analysis straight to your inbox in an exciting format once a week. Subscribe below!