- Mine Wire Media Group

- Posts

- June 11th, 2025 - The Mine Wire

June 11th, 2025 - The Mine Wire

Together With:

We are your weekly source for free curated mining industry news. With 11,000+ active subscribers, we encourage you to share The Mine Wire with your colleagues! Also feel free to sign-up with a personal email to ensure you never miss another edition.

For those of you in the Toronto region, please scroll below for more information on the MineConnect evening cruise taking place on June 19th. The Mini Mining Forum has been postponed but hit the cruise, have a few drinks, network and enjoy the city views.

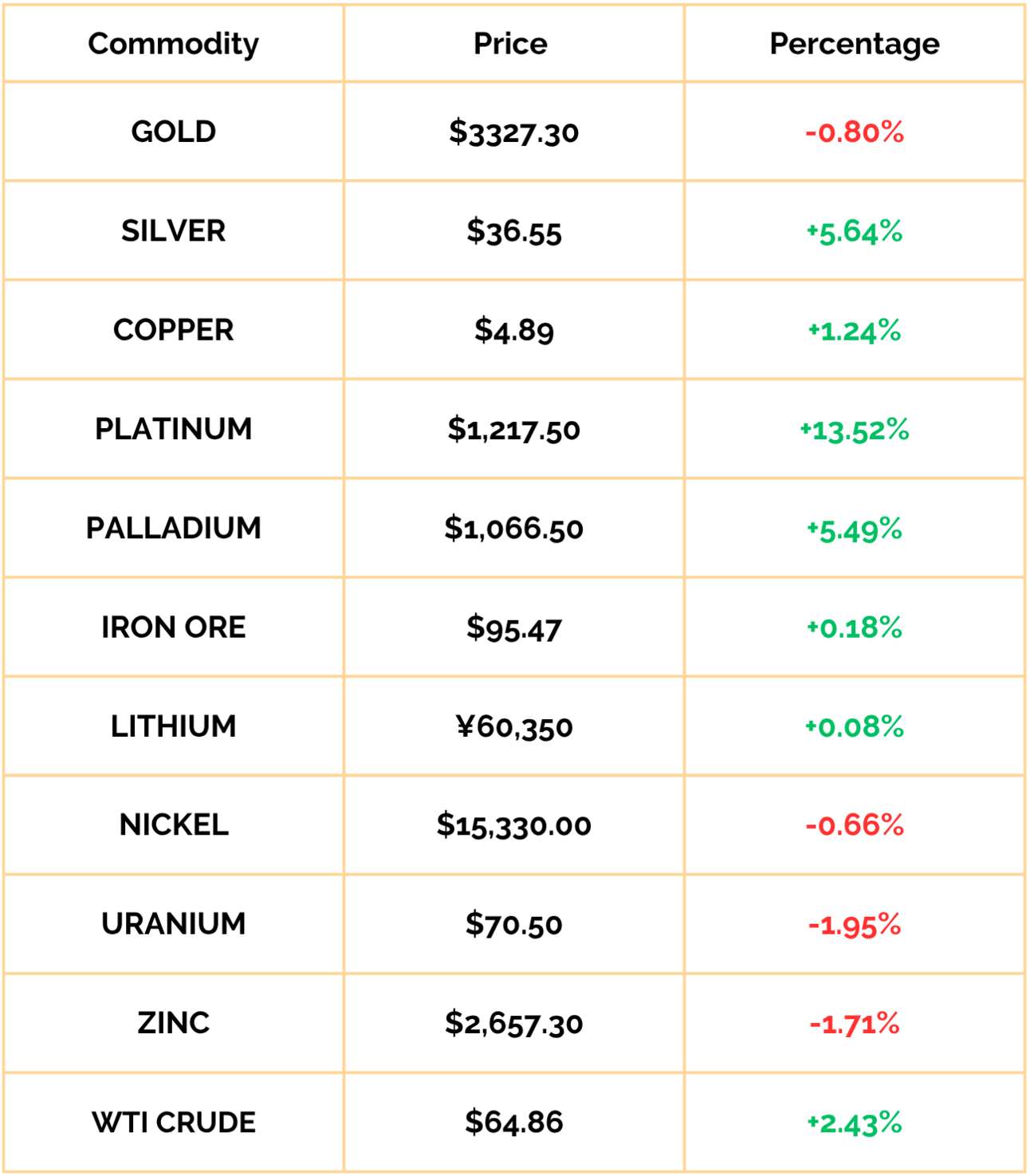

METALS MARKET

Silver hit a 13 year high this week reaching around $36.85 per oz. The increase helped the gold-silver ratio drop from 105 in April to 94 this week. With a supply deficit, robust industrial demand and meteoric gold, maybe it is time to add some silver miners to your portfolio if you haven’t done so already.

Platinum is the other significant gainer this week, up 13.52% and 24.84% the past month. Growing Chinese demand, tightening global supply and renewed investor interest have sent the metal up in May.

**For our chart above we are taking prices from Tuesday 4pm EST to Tuesday 4pm EST, so not the typical week of Monday through Friday.

KEEPING AN EYE ON GOVERNMENT DECISIONS

Here are some of the notable government policy moves this week:

🇨🇦 In follow-up to a promising First Ministers meeting in Saskatoon, the new Federal government introduced Bill C-5: One Canadian Economy: An Act to enact the Free Trade and Labour Mobility in Canada Act and the Building Canada Act. While the Bill addresses a number of trade priorities, it also outlines a process to enable the fast-tracking of national projects of interest. In the release the government has also committed to a “seamless, single point of contact - the federal major projects office” for those prioritized applications. Further, the government has doubled the Indigenous Loan Guarantee Program from $5bn to $10bn – enabling more First Nation, Inuit and Métis communities to become owners of major projects. We like the momentum so far, but there is still a lot to be done to get projects moving. (Government of Canada)

🇨🇦 Ontario’s Bill 5 was passed last week which gives the government the ability to create special economic zones. The Chief of Ontario which represents over 130 First Nations groups has said they will fight on the land and in the courts to protect their inherent, Treaty, and constitutionally protected rights. Aroland First Nation Chief Sonny Gagnon said his community objects to Bill 5. So why is that important? Well, Premier Ford has pointed to Gagnon and Aroland as a supportive First Nation as he faces criticism over Bill 5. The province came to an agreement recently to build a road through Aroland’s traditional territory which would reach the Ring of Fire. Gagnon says the First Nation never agreed to mining activities on the proposed road. At an event this week the Premier took aim at Gagnon, "Does he want the $200 million electricity deal that we handed over to him? Does he want to get off diesel because they live on diesel? Does he want a road that they can actually leave their community and drive? Does he want a community centre? Does he want a hockey arena inside that community centre? The answer is 1,000 per cent yes." and “"Mark my words in this room, he will be moving forward with us, not because of me, not because of pressuring me, because he's a smart man, and he understands his community needs to prosper." Our money is on Bill 5 being repealed. Polling shows that public support is split so we think the province will end up back-tracking on this one. (The Canadian Press)

🇨🇦 In British Columbia the government is taking a different approach with First Nations. It announced that it will work in partnership with the Tahltan, Taku River Tlingit, Kaska Dena, Gitanyow and Nisga’a Nations to develop land-use plans for the northwest of the province. One of the processes includes - clear identification of areas open to potential development, including mineral exploration and development, with clear sustainability and environmental safeguards supporting improved permitting efficiency and effectiveness. (Government of BC)

🇪🇺 The European Commission added an additional 13 projects to their list critical minerals list, bringing the total number to 60. All of the projects are outside of the European Union but focused on critical raw materials. The projects are located in Brazil, Canada, Greenland, Kazakhstan, Madagascar, Malawi, New Caledonia, Norway, Serbia, South Africa, The United Kingdom, Ukraine and Zambia. (European Commission)

🇺🇸 The U.S. Department of the Interior approved a plan by Signal Peak Energy to expand it’s coal mining operations which should extend the life of the mine by another 9 years. Signal Peak Energy applied for the extension in 2020, but had been under federal review since. It also faced litigation from local groups. Under the Trump administration’s new policies, the review was expedited and approved. (U.S. Department of the Interior)

🇺🇳 The United Nations is hosting their Ocean Summit in France this week. French President Emmanuel Macron opened the summit with a bang, saying that, “The deep sea is not for sale, neither is Greenland for sale, nor Antarctica." It was clearly a shot at the United States & President Trump. Macron touted the almost certain ratification of the High Seas Treaty which provides a legal framework for creating marine protected areas on the "high seas", or the ocean areas that lie beyond any national jurisdiction. To date, 49 countries and the EU have ratified the 2023 treaty. As soon as 60 countries ratify the treaty, it comes into force 120 days later. In his own remarks, The UN Secretary-General António Guterres also called out deep-sea mining. He said the deep ocean must not become a “Wild West” of unregulated exploitation and encouraged participants to work through the International Seabed Authority. We agree that protecting the oceans and marine life should be a top priority of all nations. If only the United Nations could do something about illegal fishing and bottom trawling which is highly destructive and indiscriminate. (United Nations), (France24) and if you are brave enough, a clip of bottom trawling from David Attenborough’s new documentary (YouTube).

🇨🇳 China has issued rare earth export licenses to the big 3 U.S. automakers. Shut downs are already happening globally across a number of industries as companies fail to source critical rare earth components. After a call with Chinese President Xi, President Trump said REE exports should start to flow. We aren’t so convinced as REE exports are really China’s Trump card - pun intended! (Reuters)

🇩🇿 Algeria has an upcoming vote on June 16th in it’s Parliament to change foreign ownership rules. Currently a foreign firm can own 49% of a project with the state owning the remainder. In order to attract foreign investment, the government’s new proposed legislation would allow foreign firms to own 80% of a project. Rich in gas, Algeria now wants to develop its phosphate, iron ore and lithium deposits. (Financial Post)

🇵🇪 Peru has backed away from a plan to reduce the size of a protected area around the country's ancient Nazca Line. In late May the government had reduced the protected 5600 square kilometers to 3,200. There was an immediate public backlash over concerns that illegal miners would move in to the newly unprotected areas. The government has said a technical panel including UNESCO will work together to build consensus on a future land use proposal for the area. (Reuters)

🇮🇩 Peru wasn’t the only government back-tracking this week as Indonesia cancelled nickel ore mining permits in Raja Ampat after public protests. With the hashtag #SaveRajaAmpat, the protests and cause went viral in Indonesia. Raja Ampat, is a UNESCO-designated Global Geopark. Never heard of a Geopark? Well we hadn’t either - these are areas designated for their international geological significance, combining conservation, education, and sustainable development. (Reuters)

MineConnect Harbour View Roadshow Cruise – Toronto | June 19

Join MineConnect and the Ontario Centre for Innovation Network for an unforgettable evening on the water! Set against the stunning backdrop of Toronto’s harbour, this roadshow cruise is your chance to connect with industry professionals, innovators, and mining supply and service leaders.

Enjoy engaging conversations, hors d'oeuvres, and drinks as we cruise the harbour. A featured speaker (TBC) will share insights into Ontario’s mining and innovation landscape, highlighting the power of collaboration across sectors.

Space is limited—secure your spot and be part of this unique networking experience!

MINING MATTERS FROM AROUND THE WORLD 🌎

The Western Range - Source: Rio Tinto

🇦🇺 Congratulations to Rio Tinto and Baowu which opened the Western Range iron ore mine in the Pilbara with the support of the Yinhawangka Traditional Owners. The $2bn project, a joint venture between Rio Tinto (54 per cent) and Baowu (46 per cent), has the capacity to produce up to 25m tonnes of iron ore per year and could sustain the existing Paraburdoo mining hub for up to 20 years. Western Range is Rio Tinto’s first project to feature a co-designed Social, Cultural and Heritage Management Plan with the Yinhawangka Traditional Owners. It is great to see this level of respect and collaboration between all parties. (Rio Tinto)

🇦🇺 In other Rio Tinto news, the AFR reported that the global mining giant is looking for government financial assistance for it’s Tomago aluminum smelter, the nation’s largest electricity user. Sources told AFR that the talks with the Federal and NSW governments are focused on the smelter’s electricity contract for 2026 to 2029 and the design of the federal government’s production tax credits. The source said, They’re running around in Sydney and Canberra looking for a lot of money… it’s billions, not hundreds of millions. It’s eye-watering.” Rio Tinto says electricity prices are way too expensive to keep the smelter open without government support on pricing. (AFR)

🇨🇦 Taseko Mines Limited (TSX: TKO), The British Columbia government and the Tŝilhqot'in Nation have signed an agreement to resolve a complex, long-standing conflict concerning Taseko’s New Prosperity mineral tenures. Under the agreement Taseko will receive $75m from the BC government and will contribute a 22.5% equity interest in the New Prosperity mineral tenures to a trust for the future benefit of the Tŝilhqot'in Nation. Taseko has committed not to be the proponent (operator) of mineral exploration and development activities at New Prosperity, nor the owner of a future mine development. The Tŝilhqot’in Nation will have to consent to any future development as part of the deal. New Prosperity is one of the largest copper-gold deposits in Canada, with a measured and indicated mineral resource containing 5.3 billion pounds of copper and 13.3 million ounces of gold. Hopefully this agreement allows all parties to move forward and realize additional wins for all involved. The market liked the news as Taseko is up nearly 23% this past week. (GlobalNewswire)

🇬🇧 Anglo American is apparently close to starting the sales process for De Beers. Insiders say that the company prefers a sale as opposed to a demerger or IPO, but the CEO has also said that the miner will be patient in order to maximize value. Three potential bidders have emerged including former De Beers CEO’s Gareth Penny and Bruce Cleaver as well as Australian mining executive Michael O'Keeffe. Anglo has wrote down De Beers value to $4.1bn, a drop of $4.5bn in just over a year. In Q1 2025, De Beers reported a 44% decline in revenue and now holds $2bn of unsold inventory. Marilyn Monroe famously declared diamonds are a girl's best friend. Maybe its time to make them a boy’s best friend too. (Benzinga)

🇨🇩 Abu Dhabi’s International Resources Holding will buy a 56% interest in Alphamin Resources (CVE: AFM) from a unit of private equity firm Denham Capital for about C$503m (US$366m). IRH agreed to pay $0.70 per share which was a discount to the public share price. Alphamin’s operations were shut in March when rebels from Rwanda entered the Congo. The company’s stock fell to $0.45 per share during that time and we suspect Denham is happy to exit a majority position they’ve held for over a decade. (Financial Post)

🇨🇩 Kore Potash (LON: KP2) secured a $2.2bn funding package from Swiss based OWI-RAMS for its Kola Project in the Republic of Congo. The deal comprises debt totaling $1.53bn and a $655m royalty portion and also gives the lender the right to buy all of the potash mined at Kola. While the stock was up initially, it was down 8% yesterday as investors likely digested the host of conditions. Want the details - check the release. From us - congratulations to Kore Potash - raising over $2bn is no small feat and speaks volumes about the potential of the project. (Kore Potash)

MINING BITS

🇸🇳 France24’s investigative team rides with the Senegalese police as they raid a suspected prostitution operation. In the past few years, the Kédougou region in the far east of Senegal has experienced an artisanal gold mining boom, with hundreds of sites and thousands of workers. This has attracted sex traffickers who lure young women from other countries with the promise of good jobs and then force them into sex work. A hard watch - video in link. (France24)

🇨🇿 The Czech Minister of Justice Pavel Blažek said he will resign as a scandal hits the government. In 2017, Tomáš Jiřikovský was jailed for online drug dealing, possession of illegal arms and embezzlement. When he was released in 2021, he made a little deal with the government - let me access my digital devices you seized and I’ll transfer you 30% of my bitcoin holdings. That 30% was 468 bitcoins or CZK1bn (€40m). Anyone with common sense would assume the crypto currency holdings were proceeds of crime and therefore, should be seized. But not the Czech government. A great breakdown in this article —> (Expats.cz)

🌎 The IEA published their World Energy Investment 2025 report. The report covers all forms of energy and minerals so check it out. Some highlights include: Coal supply is expected to rise 4% in 2025, slightly below the 6% increase per year over the past 5 years. Nearly all the growth in coal investments in 2024 came from China and India to meet domestic demand. Despite growing concerns about the high supply concentration for critical minerals, growth in investment slowed in 2024 amid lower prices, and exploration activity was flat year-on-year. While exploration spending in Canada and the United States increased marginally compared with the previous year, it decreased in Australia and Latin America. China is the largest global energy investor by a wide margin, and its share of global clean energy investment has risen from a quarter ten years ago to almost one-third today. (IEA Report)

🇮🇳 The IEA pointed out that India is one of the two key investors in coal. In fact, India has plans for roughly $80bn in new coal-power projects by 2031. The issue is that coal-fired power plants use a significant amount of water, primarily for cooling the steam cycle, but also for coal washing and other operations. A typical 500-megawatt coal plant might use 300 million gallons of water per day. There is concern that this could lead to conflict in the near future as energy companies and local residents & businesses fight over access to water. India, with roughly 17% of the world’s population, has only 4% of it’s water resources. Lots of data, graphs and figures in this one coverage —> (Reuters)

🇺🇸 CNBC speaks to Centrus Energy, an American-owned, publicly traded enricher that wants to strengthen the U.S. nuclear fuel supply chain and create competition in the market. At the moment, four companies dominate uranium enrichment. They are China’s CNNC, France’s Orano, Russia’s Rosatom and the German-Dutch-British Urenco. Centrus argues that the United States relies on foreign state-owned enrichers for its domestic supply and in a world of heightened trade tensions, the United States should look to fix that. Urenco does have a facility in New Mexico, but if recent issues around rare earth exports are any indication of future trade tensions, it certainly makes sense for the United States to build out domestic capacity. Centrus Energy (NYSEAMERICAN: LEU) is up 54.07% this past month as President Trump signals the same concerns around domestic capacity. (CNBC)

Not Signed Up to The Mine Wire Yet?

We do the hard work and curate news from around the globe related to mining and bring it to you once a week in a free and easy to read format. Whether you’re a seasoned industry professional or a curious enthusiast, our newsletter delivers the latest updates, cutting-edge trends, and expert analysis straight to your inbox in an exciting format once a week. Subscribe below!