- Mine Wire Media Group

- Posts

- April 2nd, 2025 - The Mine Wire

April 2nd, 2025 - The Mine Wire

Together With:

We are your weekly source for free curated mining industry news. With over 11,000 active subscribers, we think we are the fastest growing mining newsletter out there. If you know someone who would benefit from our newsletter, please do us a solid and send this to them.

Are you going to be at CIM’s Connect 2025 Conference in Montreal in May? Make sure you stay tuned for more info on our networking reception on Sunday, May 4th from 4pm to 7pm at somewhere tasty in the city.

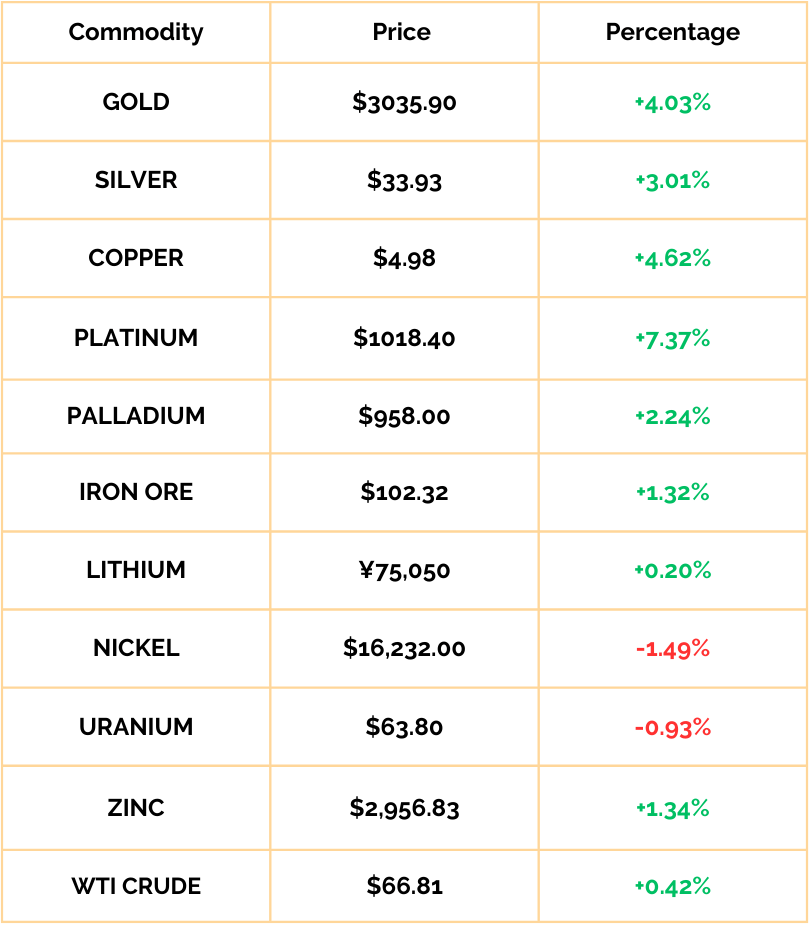

METALS MARKET

Cobalt was up only 1.06% this week to $33,965 USD/Ton but is still up +41.61% this month. Rhodium (+19.37%), Tin (+16.06%), Copper (+9.87%), Gold (+7.76%) and Silver (+6.36%) are all having positive months as well.

**For our chart above we are taking prices from Tuesday 4pm EST to Tuesday 4pm EST, so not the typical week of Monday through Friday.

KEEPING AN EYE ON GOVERNMENT DECISIONS

Here are some of the notable government policy moves this week:

🇦🇺 Australia’s Prime Minister Albanese called an election last week that is scheduled for May 3rd. Opposition leader Peter Dutton responded to the government’s recent budget and election call with his own proposed budget. It looks to be a tight race so if you want a detailed breakdown between the Labour & Liberal parties and what each outcome could mean for you, we recommend talking to our friends at Corporate Affairs Australia. We will have a full election breakdown in our May 7th edition.

🇦🇺 Newly elected Western Australian Premier Roger Cook announced changes to 9 out of 25 government departments. As part of the changes, a new Department of Mines, Petroleum and Exploration will replace the former Department of Energy, Mines, Industry Regulation & Safety. This new department will include the existing Resource and Environmental Regulation Group and will have a sole focus on resources sector. Seems like a positive change to us.

🇺🇸 Reuters scooped the news that the White House is considering an executive order to fast-track permitting for deep-sea mining in international waters. Last week, The Metals Co. (NASDAQ: TMC) formally asked the U.S. government for a deep-sea mining permit. The International Seabed Authority (ISA), created by the United Nations Convention on the Law of the Sea, has been deliberating for years on whether to permit deep-sea mining and how to regulate it if approved. The United States is the only major economy that hasn’t ratified “UNCLOS” and therefore, it could act outside of the ISA using its own domestic regulations. Currently, any country can allow deep-sea mining in its own territorial waters, roughly 200 nautical miles from shore. If the United States were to permit deep-sea mining in international waters outside of the ISA, it could create a Wild Wild West situation between major economies while raising tensions or alternatively, could help light a fire under the ISA to get some oversight and permitting rules in place. (Reuters)

🇺🇸 🇬🇱 Things continue to heat-up between President Trump, Greenland and Denmark. This week, U.S. Vice President Vance was in Greenland with his wife. The visit created quite a stir and Denmark’s Foreign Minister went to social media to post a video statement scolding The U.S. Administration. We can’t imagine that tensions between the two nations will bode well for U.S. companies trying to get their projects approved in the near term, although the U.S. threats may also be the push Greenland needs to prioritize such projects and their economic development. (AP News)

🇺🇸 U.S. Senators John Barrasso (R-Wyo.) and John Hickenlooper (D-Colo.) introduced bipartisan legislation to bolster America’s mining workforce and energy security by strengthening opportunities in mining education. The Mining Schools Act of 2025 will help strengthen America’s declining mining workforce in anticipation of increased demand for minerals and traditional energy resources. The legislation would establish a grant program for use by higher education institutions to recruit students and carry out research or demonstration projects related to mineral production. This will encourage students to pursue mining and strengthen America’s energy and mineral security by decreasing reliance on adversarial countries for natural resources. We really like this one and hope it moves through government smoothly! (Senator Barrasso)

🇨🇦 Last week, the Quebec Minister of Finance unveiled his 2025-26 budget, which significantly transforms the tax landscape of the mining sector in Quebec. This budget introduced major changes to the flow-through share regime and to the tax credit relating to resources. Both of the flow-through share regimes related to mining are gonzo. On the positive side, the budget does include a temporary increase in the rates of the tax credit relating to resources for eligible expenses related to critical and strategic minerals, to 45% and 20%. Read more here —> (Lavery)

🇨🇦 The Manitoba government is partnering with the Mining Association of Manitoba through a $1.5 million-investment to develop and deliver an internationally focused critical minerals marketing campaign to attract foreign investment to the province and diversify export markets. If we had a project in Manitoba and were waiting for permitting, we’d use this opportunity reach out to Minister Moses and ask him to also focus on expediting the opportunities that already exist. (Manitoba Government)

🇨🇦 The BC Government introduced its new framework for First Nations on mining claims. Previously, consultation with First Nations happened at the exploration permitting stage, but a B.C. Supreme Court ruled that the government needed to consult before registering claims. The result? A framework that has managed to piss everyone off. Terry Teegee, the regional chief of the B.C. Assembly of First Nations, published an Op-Ed in the Vancouver Sun to voice his displeasure. The Association for Mineral Exploration of BC also wrote a scathing open letter to the Premier, making it clear that their members concerns were not addressed. Given that the BC Premier continues to speak about making the economy a priority in the face of tariffs, we hope they get their stuff together.

CEC MINING SYSTEMS: Your Innovation Advantage

CEC Mining Systems proudly celebrates its 10-year anniversary, marking a decade of innovation and leadership in the mining industry.

Cameron Stockman, Managing Director at CEC Mining Systems, recently discussed the industry’s crucial role in global decarbonization efforts. He highlighted the imperative need for transitioning from oil and gas dependency to sustainable metal production, essential for supporting the renewable energy sector and achieving climate goals.

In his insightful discussion, Cameron emphasized that sustainability in mining extends beyond environmental stewardship to include robust community engagement. He pointed out that past project failures often stemmed from a lack of local support, underscoring the importance of fostering long-term relationships with communities. Ethical practices in the industry not only enhance project success but also contribute significantly to global sustainability goals, ensuring that the benefits of mining are shared and sustained.

As CEC Mining Systems looks to the future, we remain committed to leading the charge in sustainable mining practices. By prioritizing both environmental and social responsibilities, CEC Mining Systems continues to set the standard for the industry, driving positive change and supporting the global transition to a low-carbon economy. For more information, visit CEC Mining Systems and connect with us on LinkedIn.

MINING MATTERS FROM AROUND THE WORLD 🌎

🇨🇩 A few weeks ago, it was reported that KoBold Metals was in discussions with the government of the Democratic Republic of Congo to develop a large hard rock lithium deposit at Roche Dure. Well they now have some competition as Rio Tinto is also talking to the government about developing the deposit. Investment in the deposit has been held up due to a dispute involving Australia’s AVZ Minerals Ltd., China’s Zijin Mining Group Co. and the government. (Reuters)

🇧🇷 Brazilian miner Vale has agreed to form a joint venture with U.S.-based investment firm Global Infrastructure Partners through its Brazilian renewable energy business Alianca Energia. Vale will sell a 70% stake in the business for a cool $1bn USD. (Reuters)

🇵🇪 Peru’s Buenaventura mining company signed a concession contract with the Peruvian government for a water project in a bid to develop a major copper mine. Peru's Minister of Economy and Finance, José Salardi, stated today that the execution of the El Algarrobo project (Tambo Grande, Piura) represents a turning point for new mining investment, especially in projects and actions for water conservation. "We believe this project will be an important turning point for the new mining investment that can be developed," he said. The project investment over 10 years is expected to be $2.7bn USD - definitely a big win for Peru. (America Economia)

🇯🇵 Panasonic Energy and Sumitomo Metal Mining announced that they will collaborate in the recycling of nickel for lithium-ion batteries. Under the scheme, Sumitomo Metal Mining will recycle nickel from battery scrap generated at Panasonic Energy’s factory in Japan. This nickel will then be reused as cathode materials in the company’s lithium-ion batteries. The initiative will initially focus on nickel recycling, with plans to extend the program beyond 2026 to include other key cathode materials, such as lithium and cobalt. We love the circular economy so like this initiative. (Panasonic)

🇺🇸 🇨🇦 In less positive recycling news, Canada’s Li-Cycle issued a warning to shareholders on Monday: “Li-Cycle requires additional financing to meet its obligations and repay its liabilities arising from the ordinary course of business operations when they become due in order to continue as a going concern. The Company is presently aware of no additional sources of financing to meet its obligations and repay its liabilities arising from the ordinary course of business.” Glencore has been in talks to acquire the company it previously invested $275m in. The company lost $137.7m in 2024 on $28m in revenue. The market cap today is $11.72m CAD and the stock is down 95.84% the past year. The company qualified for a Department of Energy $475m loan in November last year to build a new recycling facility in Rochester, NY, but those plans have stalled. (Businesswire)

THE MINE WIRE RECEPTION at CIM CONNECT

The Mine Wire is thrilled to bring you our 2nd Annual GetConnected! Reception at the CIM Conference 2025 in Montreal next month!

📅 Date: Sunday, May 4th

⏰ Time: 4:00 PM – 7:00 PM

📍 Location: Top secret… for now!

We’re teaming up with some AWESOME sponsors like Kalenborn Abresist Corporation and their Canadian partners at Int-elle Corporation Inc. alongside CEC Mining Systems and X-Glo North America to create an unforgettable evening of networking, great conversations, and industry connections. This is your chance to mix, mingle, and kick off CIM | Canadian Institute of Mining, Metallurgy and Petroleum 2025 with top professionals in mining!

Stay tuned as we reveal more details shortly. But for now… mark your calendar and get ready to GetConnected! w/ The Mine Wire.

Want in as a Sponsor? Reach out to [email protected]

MINING BITS

Degana, in the mountainous region of Asturias, Spain

🇪🇸 At least 5 miners in northwest Spain lost their lives this week while 4 others were seriously injured. Adriana Lastra, a representative of the central government in Asturias, told reporters at the scene that initial indications showed the blast may have been caused by methane forming an explosive mixture in the mine, a phenomenon known as firedamp. Our thoughts go out to all the miners and their families. An unfortunate reminder that safety is of the utmost importance on mining sites. (Al Jazeera)

🇺🇸 JPMorgan Chase & Co. is the latest organization to leave the Net Zero Asset Managers initiative. Blackrock left back in January which lead to a suspension in efforts by the initiative. (Reuters)

🇰🇷 South Korea’s Ministry of Trade, Industry, and Energy established the Rare Metals Industry Development Association, aiming to analyze and assess the country’s rare metals supply chain and related technologies to respond to changes in the international market. (Trend Force)

🇰🇷 Unless you live under a rock, chances are you’ve heard of WallStreetBets. Well one American asset manager recently published a note calling South Korea “The Squid Game Stock Market,” arguing that Korean investors are fueling volatility in U.S. markets. How so you say? Well, like WallStreetBets, South Koreans are using companies like Toss Securities to trade and discuss investments. In Toss Securities case, they have an investor community feature where people can discuss their trades, creating both “pump and dumps” as well as herd mentality in investing. According to The Chosun Daily, “In recent months, South Korean investors have driven extreme price swings in high-risk overseas ETFs, such as leveraged and inverse funds, and even in small-cap U.S. stocks with minimal market capitalization.” In November alone, users traded more than 30 trillion won (about $20.4bn USD) worth of overseas stocks through Toss Securities. Guess its finally time for us to publish The Mine Wire in Korean! (The Chosun Daily)

Not Signed Up to The Mine Wire Yet?

We do the hard work and curate news from around the globe related to mining and bring it to you once a week in a free and easy to read format. Whether you’re a seasoned industry professional or a curious enthusiast, our newsletter delivers the latest updates, cutting-edge trends, and expert analysis straight to your inbox in an exciting format once a week. Subscribe below!